In the midst of the coronavirus scare, the world may be looking at yet another major financial crisis; one that we may not get out of any time soon. Unlike most major financial crashes in history, though, this one would have little to do with human greed – or even human stupidity.

While most people’s context for a financial crisis is limited to the one in 2008, it was far from being the first, or even the last one. History is full of examples of what happens when we mess with the economy too much, though for some reason, we tend to keep repeating the pattern. While some of these were a result of entire societies not knowing how money works, others ended up being textbook cases of corporate greed and material excess.

From the peculiar tulip bubble of 1637 to Europe’s current debt crunch, here are our picks for the biggest financial crises in history.

8. The Late ’80s Housing Crash

When we talk about stock market crashes, the one in 2008 comes to mind, as almost everyone reading this is probably going through one of that one’s long-lasting, far-reaching after effects. Billions of dollars were wiped out of the global supply within a few hours, triggering a mass recession that would have massive consequences for the world. But then again, it wasn’t the biggest single-day crash in the American stock market’s history. The one in 1929 wasn’t either, if that’s what you guessed. That honor actually goes to the housing market crash of 1987.

Also known as ‘Black Monday’ among the trading community, the stock market lost 22.61% of its value in a single day, coming immediately after the booming years of the housing market in the early ’80s. While a similar drop today would probably not mean much, it’s only because the stock market today is far bigger than the one in 1987. It’s a lot more interconnected with the global economy, too; a similar crash today would take many more countries and global businesses down with it.

7. The Tulip Crash Of 1637

Back in the 17th century, when almost all of the Western European countries were looking to expand their borders, Holland was taken by a whole new craze (in addition to expanding its borders, of course). The Dutch had just been introduced to tulips from Turkey for the first time, and they liked them so much that they started buying and selling them as valuable assets. They were immensely taken by the unique shape and the variance of colors found in tulips, and while it was restricted to the elites in the beginning, soon almost everyone was in on it. People were mortgaging their houses to buy especially expensive varieties of the beautiful bulbs, hoping someone would buy it from them at a higher price. As anyone who has studied basic economics would tell you, though, that was already a recipe for disaster, as tulips don’t inherently have any value.

As the bubble burst and people ran to divest their money from the useless plants, the Dutch economy saw one of its biggest – and possibly first – financial crashes. The tulips lost their value almost overnight, and many middle-class Dutch families lost a big chunk of their savings in the crash that followed. The Tulip Craze is still studied as an example of how asset bubbles and ensuing financial crashes work. As this entire list proves, however, we don’t learn that easily.

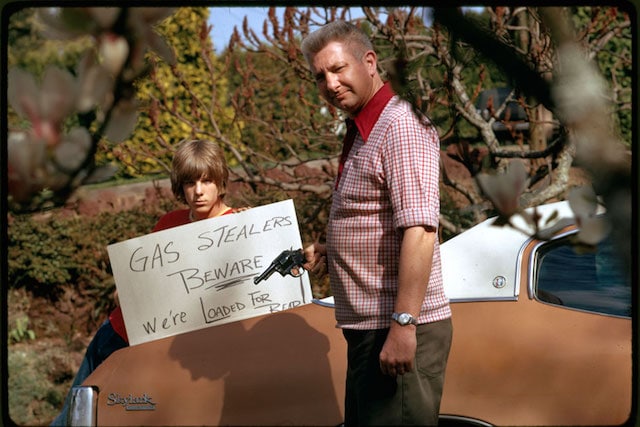

6. The OPEC Oil Price Shock Of 1973

The Middle East has been the backdrop of quite a few major events of the last century, one of them being the formation of Israel. While we won’t get into the rather dangerous territory of commenting on that, it was – by all accounts – a turning point for the Middle East, and influences geopolitical relations in the region (and beyond) to this day.

One of its most devastating consequences – at least for that time – came in the form of the various energy crises of the late ’60s and early ’70s. The worst one – the Middle Eastern oil producing countries’ (also known as OPEC) oil embargo of 1973 – came on the heels of the Yom Kippur War. It was aimed at punishing the countries allied with Israel in the war, and was largely successful, too. The embargo pushed the Western world into a mini recession, and forced many countries to look elsewhere for reliable supplies of oil. Inflation suddenly shot up in many of those countries, accompanied by high unemployment and emerging civil unrest. It also had other immediate consequences, like the fall of the Tory government in the 1974 UK elections.

5. The Current European Debt Crisis

Whenever we discuss the longterm consequences of the 2008 financial crash – which we’ll come to in a bit – the focus is usually on the global south. While it’s true that the developing world has been disproportionately affected by it, its most globally-relevant effects are – much like everything else – concentrated in Europe. If you thought that European countries have been going through a lot in the past few years, you’re not wrong. They have been, and the reason is their ongoing – and more pronounced than ever – debt crisis.

While almost all of Europe is going through one of the other of its consequences, the crisis – when it was first identified around early 2011 – has been mainly concentrated in five countries: Italy, Greece, Portugal, Spain and Portugal, as these are the countries with highest accumulated debt. The problem has only got worse in the last few years, and has been responsible for quite a few major events of the last decade, such as the rapid rise of radical, populist parties in and around these countries, an essentially stalled economy in almost all of Europe, and pretty much the whole situation in Greece.

4. The Suez Crisis Of 1956

The Suez Canal has held an irreplaceable position in global trade for almost all of civilized human history. Just look it up on the world map, and you’ll see why. The canal provides a crucial passage for trade between European powers and their rich colonies in the East, and control over it – for a huge chunk of history – meant control over the world. Obviously, it has been the cause for many conflicts in history, too, though eventually all the stakeholders decided that it was best to cooperate on this one some time in the 19th century.

That cooperation lasted till 1956, when Egypt decided to nationalize the Suez Canal Company and take control of the canal. While not a major financial crisis compared to what we see in the rest of this list, it was still huge for the time, especially for the UK. It was also the first test of its scale for the International Monetary Fund, whose support to the countries most affected by it – like the UK – served as a blueprint for many more financial crises in the future.

3. The 2008 Financial Crash

When it comes to the who’s who of financial crises in history, the one in 2008 definitely gets a prominent seat at the table. It was by far one of the most consequential events of our times, and it’s effects could still be observed in many regions of the world. Much like the housing market crash of the late ’80s, this one was caused by an artificially-inflated housing market, too; only this time, the market was much more entangled with the global economy. As a result, the 2008 crash turned out to be the biggest global financial shock since the crash of 1929.

Trillions of dollars were wiped out of the global economy overnight, and the global recession caused by the crash unleashed a wave of civil unrest and conflict across the world, with some far-reaching consequences. It also exposed the greedy practices within the financial and banking sector, massively contributing to the popular – and growing – wave of mistrust of the political and social elite in the West.

2. The Great Depression

Financial crashes – no matter how huge – are always compared to the one in 1929. Rightfully so, too, as even if the actual crash may not have been as big, it’s the gravity of its longterm consequences that earn it its place as the worst financial crisis in human history.

While there were too many factors that ultimately culminated into that fateful day on the New York Stock Exchange in 1929, the most influential ones were the usual suspects like corporate greed, unbridled excesses of Wall Street not in line with the actual state of the economy, and the often self-correcting belief that a rising stock market will continue to rise indefinitely. Of course, we don’t have to tell you about its consequences; we’ve all seen the pictures of the millions of families that were rendered homeless and without food overnight. Its biggest consequence, however, came in the form of the biggest war the world has seen barely ten years after it happened: the Second World War. It’s no exaggeration to say that the Great Depression set the stage for almost every event of the next twenty years, and in turn the rest of the century.

1. The Current Coronavirus Crisis

While it’s not technically a financial crisis in history – as it’s currently well ongoing – the recently-officiated global recession caused by the novel coronavirus deserves a spot on this list. According to some analysts, it may well be the biggest financial crisis ever, which doesn’t seem to be that farfetched if you actually look at the details.

For the first time in their history, entire industries – like hospitality, airlines and tourism – are at a very real risk of insolvency, as they rely on continuous operations and profit to be feasible business models. That is, of course, if we don’t include the industries the pandemic has already decimated, most of which are concentrated in emerging economies. It’s trouble for the developed world, too, as it has actually been disproportionately affected by it. The USA, for example, just signed its biggest bailout package in history into effect, and according to some, even that may not be enough.

It’s especially bad for some of the worst hit countries – like Italy, China and Iran – as they were already going through other problems like high rates of inflation, slowing economy, and political turmoil. While it’s not the best idea to focus on the economy at a time more people are getting infected and dying than ever, it’s crucial to take the right steps to remedy the pandemic’s worst longterm economic effects, something government’s the world over are failing at.