By this point, regular readers and viewers of TopTenz have surely been made so wealthy by the knowledge we’ve provided that they have some money to save. But no matter how much cash they have available, what they always seem to have more of is investment options. Lucrative options. Safe options. Options that make investors feel like they’re cleverly gaming the system. And in pursuing these investments, many people are rushing into plans that either will, or may soon, make them lose the shirts off their backs.

Well, we’re here to help you be aware of what you might be getting into. Now, we’re not going to tell anyone to not to pursue any of these options if their heart is set on it. After all, TopTenz isn’t a parent of any of our readers in a physical or legal sense ( …that we know of). We’re just suggesting investors be cautious, highly alert, and ready for potentially huge disappointment.

10. Real Estate

At some point everyone who is renting their living space has been told that they would be much better off owning a home, and Time reports that three quarters of Millenials believe it. After all, land is a physical object and thus intrinsically has more value than any currency. Any rent money spent is sunk cost, while every check that goes to paying off home ownership is an investment in the future. Millenials are even applying the concept of crowdfunding to buying houses and brick and mortar business places.

The issues with owning a home instead of renting a space include the fact that the average home brings with it $1,100 maintenance costs, plus all the time that goes into it. Real estate prices since 1900 have increased ahead of inflation, but only 1.3%. For comparison, an average investment in a blue chip stock made more than four times that (more on that later). Meanwhile, in the Housing Crisis of the Aughts, an average home’s value dropped 23%. In the event of a similar crisis occurring again, a homeowner’s odds of owing more on their mortgage than the value of their home for the years-long recovery process are roughly 33%. Considering the extra problems, such as the difficulty and expense of selling a house, renting is a much safer bet than the traditional romanticism of owning a house would have us believe.

9. Bonds

Bonds aren’t just considered a safe investment. The whole reason they can get away with relatively low interest rates is because they’re the cautious investor’s choice. There are also the options of municipal and corporate bonds for those who don’t trust treasuries.

However, it’s that very low interest rate that can be the problem even as it lowers the likelihood of the bond issuer defaulting. It’s quite possible that the interest payout from a treasury bond won’t be able to keep up with inflation, meaning that an investment will be worth less every year. Bonds issued by other countries or private companies are often called “junk bonds” precisely because of the high risk of defaulting in pursuit of higher interest rates. Also, with corporate or municipal bonds the issuer can call (i.e., return the investor’s cash before the interest is earned) for less than market rates, costing a considerable amount of the interest the investor was hoping to get anyway.

8. Oil Stocks

Even with Millenials supposedly being more environmentally conscious, many of them are going after mineral stocks in the form of petroleum. In 2015, the fifth most commonly traded commodity on the market by Millenials was WTI Crude Oil. Since petroleum is such a vital product, it seems reasonable enough to think it’s a solid bet.

The truth is that the market is so unpredictable that even when the price of petroleum broadly increases it can fail to raise the value of stocks for oil. This is true even with the most recent trades. On January 31, 2018, it was reported that even with demand for oil rising, US oil stocks were declining. Adding to the risk is the rise of renewable energy sources, leading to such bold steps as Norway in divesting in oil stocks in November 2017. Even leaving aside how effective the transition to environmentally-friendly energy turns out to be, the fact numerous countries around the world want to abandon their oil stocks at all is enough to shake up the market.

7. Mutual Funds

Even in the wake of the 2008 Financial Crisis that would have signaled to many that the supposed experts like mutual fund managers don’t necessarily know what they’re doing with everyone’s money as well as they claim, Americans in very large part seemed to continue to put their trust in them. As of February 2017, the Investment Company Institute reported that 55 million households in America have mutual funds – roughly 43.6%. It is a tempting offer to assume that someone who has spent their life following market trends will have all the answers and make the investor’s household a nice return while they get on with their lives.

Doing so can likely cost a small fortune in lost potential income. In August 2015 alone, Fidelity Mutual Fund lost a billion dollars. Yes, it was divided among numerous customers, but it was very far from the profit customers seek from such an investment. Even if things don’t fail so dramatically, Forbes reported that in 2012 more than 66% of mutual funds performed below the S&P 500’s industry average. Trusting the experts is truly not a magic bullet.

6. High Dividend Stocks

So let’s imagine an investor still has their eyes on the stock market. Instead of trusting mutual funds, they target specific stocks. Ones which will pay them more dividends, which roughly translate into quarterly payouts for how many shares of the company they own (i.e, receiving a dollar per share). Even if the value of the company fluctuates, unless something very drastic like the company completely failing happens, the shareholder will still get their regular payments. A nice bonus is that dividends are tax exempt if the investor uses the dividend reinvestment program to be paid in shares.

The problem with that is that those same dividend rates will often be a red flag for a company if they’re high enough to catch an investor’s eye. It’s very likely cutting into the company’s earnings in a way that will drive the share values down. Also, an extremely high dividend rate (say, 10% of the share’s value annually) often signals that the company is on a dangerous downward trend and hasn’t adjusted its dividend rates. In short, tempting dividends might suck the company dry in an attempt to draw new investors.

5. Certificates of Deposit

CDs have got to be considered the safest investment that produces any form of interest. The investment is backed up by the Federal Deposit Insurance Corporation, so barring something truly catastrophic happening to the nation at large, it’s just going to sit there at a bank or similar financial institution and earn interest. Not a huge return, to be sure, but the investor went this route for security, not thrills.

The thing is, many CD accounts will lock the investment into a rate not just below inflation, but where the interest rate won’t adjust in keeping with average federal CD interest rates. Add to that how many investors might need to withdraw the money, and that transaction will cost a significant chunk of change. 92 percent of all CD plans have a penalty for withdrawing that would be the equivalent of three months interest on the CD and six months interest. While an investor won’t lose everything or go into debt from that, given the likelihood they’ll need that money sooner than they’d planned, it is enough that they should be aware of the risk of coming out of the investment in the red.

4. Joint Bank Accounts

An investor sharing a bank account with their elderly parents or children seems like a convenient, responsible way to keep an eye on their spending habits. It also keeps it possible to cancel checks in time to avoid frivolous or impaired spending. If nothing else, it allows cash transfers to prevent accounts from being overdrawn and incurring fees.

One of the larger problems with this investment approach is that all the money involved in the investment counts to both parties, so if the elderly parent or the child at some point need to apply for financial assistance, all the money in the account is counted as the applicant’s and will likely be used to deny them aid. Additionally, if spending rises above a certain level ($13,000 as of 2017) then additional tax issues will arise, not to mention it leaves the accounts of both parties vulnerable to liens and other forms of debt collection. Time magazine and similar publications argue that the much safer way to use money is to spend a few hundred dollars to get power of attorney.

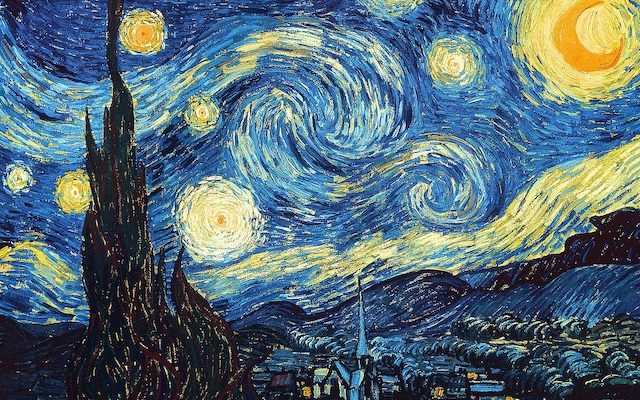

3. Fine Art

This is more reserved for the wealthier investors with, to paraphrase Jay-Z’s The Story of OJ music video, one million dollars they want to turn into eight million dollars in a few years. Still, for years it’s been known as a hotbed of corruption on a broader scale, which surfaces in the news every once in awhile, such as in 1988 when New York City announced pricing display regulations to avoid price manipulations. Indeed, paintings and other pieces of fine art are often used to launder money and bribe politicians (donate the painting to said politician, then buy it back at an inflated price). Investing in an industry so full of criminal behavior and abstract values all but guarantees neophyte patrons will soon be doing deals with some shady characters.

Beyond that, there are some ugly and discriminating practices that occur at surprisingly high social circles, too. A high profile example was when it took the personal intervention of painter Jim Hodges to convince a gallery to sell one of his paintings to Daniel Radcliffe in 2007. And good on Radcliffe for not just slipping on his invisibility cloak and taking the painting. There are also numerous galleries where hired phony bidders at art auctions attempt to inflate prices by playing off patrons’ competitive instincts. There have been attempts to legislate these phony bidding practices, but the laws never seem to get enough support to pass.

2. Gold

While the value of gold over centuries has consistently increased in keeping with currencies, the problem is that it’s risky to store in a private residence and costly should the owner feel the need to buy a lockbox or safe. And that’s after the cost of acquiring the gold, which means that the investor is already in the hole by the time the precious metal arrives. Any investor who wants to bypass the expenses and risks of having gold in their homes might try to buy gold bonds, but they’re not actually redeemable for a speck of the metal itself.

And even if there’re the sort of global catastrophe that gold is most heavily pitched for (i.e., that it’s the investment that will literally always have value) then the government has the right to confiscate privately owned gold, and in the case of even the US government has done so in the past, such as in 1933 when FDR’s Emergency Banking Act required anyone who owned gold to turn it in to government-approved banks. In that case the gold owners were compensated, but who knows if that money will have value for long if the government needs to take such extreme steps.

1. Bitcoin

Admittedly most people who are investing in this and other cryptocurrencies are aware that there’s a degree of risk in it, but they likely assume the cryptocurrency is more streamlined by this point than it actually is. Even people who have made millions of dollars in Bitcoin admit that it’s in bursting-bubble mode instead of likely to pay off in the future. Numerous businesses have already stopped accepting it such as the online store Steam and Microsoft.

Valuing Bitcoins properly is impossible and as of December 2017 accounts still aren’t secured properly. Add to this the fact that the speed of transactions is unpredictable. Even if the price for bitcoin is way up, it can take 10 days for the sale to process, leaving plenty of time for it to have crashed again by the time it’s exchanged for regular cash. Considering the high transaction fees that were a significant part of the reason the aforementioned companies no longer support Bitcoin, it seems like it’s a very unreliable way to make a profit.

Dustin Koski is an extremely conservative investor as a result of writing this. You can follow how that works out for him on Facebook.